A lot has changed for the business model of theatrical cinema over the last 18 months. One of the bigger issues that has had little analysis is the effect of reducing the typical 90 day theatrical window to 45 days. In this article I will discuss how this major modification in the theatrical model will likely result in unfortunate collateral damage to particular sections of the industry.

Taking the temperature of the Industry

Numerous end of year industry articles from trade websites have already been published and I expect many reading this are familiar with them. Variety (https://variety.com/2022/film/box-office/spiderman-no-way-home-box-office-new-years-1235145892/) specifically sticks in my mind. It indicated that over Christmas, apart from Spider-man, all other films are considered flop or soft (Relative to pre-pandemic expectations). As a small cinema exhibitor, I would have to generally agree with this opinion. From my perspective as a small exhibitor, one successful film does not make an industry. The behaviour around many other films coming to screen over Christmas gives us an indication of the likely future performance of attendance.

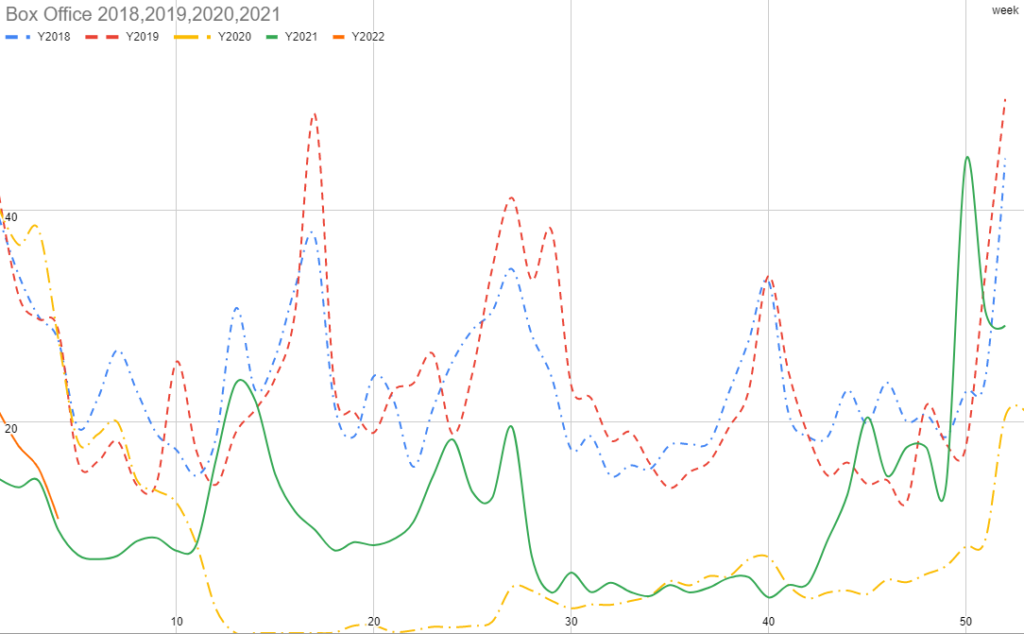

As I am from Australia and exposed to Australian numbers specifically, let's take them as an example. Below is a performance graph for the Australian market based on the Numero weekly GROSS numbers.

This is an image from a LIVE Google Sheet I use to gauge the performance of the Australia exhibition industry. I update it regularly of which you can access a VIEW only link here:

Looking at this graph, you can see that before Christmas 2021 (the solid green line), Australia had a run up, I would consider a glut, of tent-pole films that performed within close proximity to pre-pandemic levels. This was expected due to the number of tent-pole films arriving in Australia before Christmas, the lifting of lockdowns and the fact that Omicron was not on the public radar. This glut of films only achieved a Box Office gross that would be considered soft. With so many tent-pole files in a short period, a reasonable or even better then pre-pandemic box office gross was expected, but unfortunately box office gross was only able to get to the lower bounds of pre-pandemic levels. There was also a perceived lack of excitement or anticipation for coming back to cinema during this period.

It was only when Spider-Man appeared that the "Risk Budget" level was achieved. This is a term I give to customers consideration of risk. Consumers appear to stay away until they see a perceived risky event they will invest in and are willing to "take a risk" and go out to a group event.

Spider-Man is a good Marvel Cinematic Universe film, and as word of mouth spread, people's motivation to enjoy a group event with a guaranteed result snowballed around Spider-Man, while the rest of the content languished. Sing 2 did have some success and held well. By the end of the holiday period it was considered a strong title, it just took a while to build.

The reason I am pointing this out is because I want to point out the original article from June 2021 called "CJ Analysis: By the Numbers, What We Can Expect for Cinema Attendance After Vaccinations" - https://celluloidjunkie.com/2021/06/21/cj-analysis-by-the-numbers-what-we-can-expect-for-cinema-attendance-after-vaccinations/ as the current attendance levels are holding true to this articles predictions and are only looking stronger based on behaviour over Christmas.

The graph above shows in Australia, 2020, Box Office was 33% of max Gross levels from 2018, and in 2021 was just under 50%. External trends indicate that PLF type cinemas are doing the best.

With government support now being withdrawn as the COVID-19 crisis appears to be behind us, uncertainty due to the War in Ukraine, petrol prices going up and the expected inflation to follow, economists budgeting in 3-5 interest rate rises to combat inflation, stagnant wages, an expected stock market correction in 2022 as stimulus is removed and rates rise, studios sacrificing numerous tent-pole films to the streaming gods. It goes on. We must expect a long suppressed attendance as was indicated in the " CJ Analysis: By the Numbers..." article.

While the average gross profit for general businesses is 10%, (although I believe cinema profits are generally a bit higher), a predicted permanent drop of 20%+ of attendance will result in a re-calibration of cinema locations and screen numbers.

Ultimately, the prognosis is that the industry will be under a lot of pressure moving forward. Obviously it's going to survive, but in established markets, there will be considerable pain.

How do 45 day windows affect exhibition?

There has been much analysis on how long windows should be. 45 days is the sweet spot. Refer to the "CJ Analysis: By the Numbers" article mentioned above as it covers this in more detail. After 45 days over 95% (average) of exhibition gross has already been accounted for. Naturally, if that is the case, the content owners would like to move onto the next stage of the life cycle for a movie's release as they are in a better position to leverage the already paid for advertising and awareness of the movie.

As a cinema owner, I would prefer to still see a 90 day window as the 5-7% that is being cut off the long tail is not insignificant. But it's the producers' content and you cannot blame them for doing what's best for them. And after all, we must evolve.

One very important factor has not been taken into account. The cinema industry is very old, and specific business practices exist to cater for the historic nature of the industry.

For example, traditionally back in the physical film days, film prints were extremely expensive and only a limited number were available. To make sure only the right number of film prints were produced that went to the best locations to obtain maximum return, the term "First Run" ,"Sub Run" and also "$1 cinema" came into existence.

This practice resulted in regional exclusivity as the larger cinemas run by the major chains were prioritised over other cinemas close by. This eventually killed off the smaller cinemas in competitive locations. The side effect of this was regional monopolies.

As you would expect, this was found to be very beneficial to distributors and exhibitors as they were in a position to charge what the market would bear, with the aim of maximising profits.

This behaviour was allowed due to the high costs of film prints, however, we have been digital for near 10 years now, and although the costs are negligible in sending a film in digital format (DCP) to any cinema, policy and first-run/sub-run classifications are still in use today in most markets.

It is understandable that the industry would prefer to keep this dynamic in play as it is extremely profitable.

It is when we introduce the now acknowledged effects of date-of-release-streaming that we can start to see where this is going to fall down.

CinemaCon 2021 was the year the industry categorically declared that date-of-release-streaming does not work. John Fithian of NATO, speaking at CinemaCon 2021, stated “What the future holds is up to our members and distributors to decide, but let us be clear about one thing: Simultaneous release does not work for anyone ...”

As has been demonstrated over the last few years, the loss of box office gross to date-of-release-streaming is substantial and a market collapse would likely result. Distributors have since backtracked on this and the 45-day window is the compromise.

As has been established, a large number of cinemas are restricted from playing content until 3-5 weeks after favoured first run locations. This unfortunately puts these locations under a similar "industry collapse" scenario. A restricted cinema can only get a film 1-4 weeks before it hits the streaming windows of 45 days, but typically, if a consumer has not had the time to see the film, or the word of mouth on the film is at all questionable, consumers are deciding to wait for the film on streaming/piracy channels (Streaming anywhere, piracy everywhere) as it's not that long to wait. The permanent drop in attendance is expected to be significant for cinema locations forced into this position.

Over the last 18 months it has been established that films are becoming "Front Loaded". This reference is to the percentage of box office gross that is taken in the first 1-2 weeks. A new trend that has been identified during COVID is that many films have dropped in box office gross levels faster from week to week. For example, it is commonplace to see a 50-55% drop in box office gross takings on second week. Due to the changing environment, it is now commonplace to see an estimated 60-70% drop. This means, more and more of the box office gross is taken in the first two weeks, leaving less for cinemas who are restricted to taking the film after this period.

It is not unreasonable to expect a 50% drop in attendance/gross for cinemas in this position. No cinema could service a permanent drop in attendance of this amount. All commercial cinemas under these restrictive practices are likely to permanently close.

This is the collateral damage we can expect from 45-day windows.

Who and how much of the industry is affected?

This is a difficult question to answer. But in general any cinema under restricted access is likely to be severely affected. The question is, how much of the industry in your region is under this restrictive behaviour?

To figure this out, I used the Australian region, as that is where I am based and know best. I wrote a tool to scrape all cinema session times and from there calculate screen numbers and average delay each location is exposed to. This site can be found at:

Note: Recent COVID conditions have distorted the results ,as it is updated in real time as weeks pass, but it still portrays the likely outcome.

This is a site based under the “Small Cinema Owners Association” (SCO) in Australia of which I am the principal. This webpage represents nearly all cinemas that have been active in Australia in the past 3-4 years. If you click on the “Delay?” column it will sort the cinemas by the average number of weeks the site plays a film after its date of release. There is more detail on the website on how these numbers are calculated, what represents a wide release etc.

From here you can scroll down to the locations that are 3 weeks or more average delay. You will notice that these locations are all independent or possible part of a Mini-chain. They are also typically 1-2 screens, occasionally 3 screens as policy and restricted access is only applicable to smaller cinemas in Australia.

Locations on 3 week or higher delay are predominantly regional locations. Please review this page (https://data.smallcinemaowners.com.au/dashboard/heatMapDelay) on the data site to visualise the locations based on delay. Example image from the webpage below.

Considering this example of who is affected, it is hoped the reader can apply these characteristics to their local market to get an idea of how it will be affected. In Australia, 25-30% of current locations, predominantly regional cinemas are estimated to be affected.

As an example of this effect already taking place, please refer to the following news article about numerous small cinemas closing in Australia with indication of exactly the issue described above as the cause:

- Regional cinemas close their doors as COVID-19 and streaming services take a toll - https://www.abc.net.au/news/2021-12-04/regional-cinema-closures-covid-netflix-streaming/100630936

- We didn't want to close': Longreach's beloved Star Cinema calls curtains after 33 years - https://www.abc.net.au/news/2021-07-03/longreach-star-cinema-closes-norm-edna-salsbury-retire/100251836

Example of U.S. cinemas under the same pressure as the Australian data demonstrates above:

Indie Movie Theater Chains Struggle to Survive as Windows Shorten

https://www.hollywoodreporter.com/business/business-news/indie-movie-theater-chains-struggle-to-survive-as-windows-shorten-1235107040/,

Quote, "The collapse of the second-run market is one more sign that owning an independent theater chain has become exponentially more challenging since the COVID-19 pandemic upended moviegoing habits two years ago.",

Quote: Adding to the challenges, mini chains continue to feel that the playing field with the deeper-pocketed competitors isn’t always level. Cohen cites an example from late last year, when R/C was denied early-access shows for Sing 2 because she was told that a bigger name across town needed a fair share. “I argued, ‘You’re really going to tell me that we can’t show this here because you want to give it to a national chain?’” she recalls. “We lost that argument.”

What can be done

When a movie is released on streaming, every living room becomes a potential cinema experience for the consumer. There is no limit on what device or location you can watch the movie. The transaction is as seamless and convenient as possible to ensure to net the streaming company throws into the market catches as many customers as possible.

If we use this same approach for a small cinema in a regional location with a limited catchment. The main objective for the cinema owners is to offer content to its community that is of a wide appeal. For example, films of different target demographics. A kids film, an action film, a mature film, a comedy, an animated film, etc.

It is far better for a small cinema to play five different films per day while in early release then it is to bet on two films for three weeks which they hope will have a wide appeal. If they pick a flop, they are stuck with it riding out the commitment and switching to another more popular film ASAP.

With a wide variety of content available, cinema owners then let the consumers decide what films are popular or not. And based on the performance of the films on offer, hold over the films that customers keep coming back to see.

This would maximise customer appeal and attendance. It would lead to a feeling of the cinema looking after the consumers interest and encourage more attendance. I must note here, as a small cinema owner who has to skip many films due to these restrictive conditions, this poor treatment of the consumer leads to much higher levels of piracy in regional areas. If you treat customers poorly, they feel justified in behaving poorly.

To reach the above outcome, no restricted access and no policy requirements would have to be allowed, like is available to consumers via streaming. The adoption of this model, which allows smaller cinemas to react to what the customers want, would be the best way to help save them from becoming collateral damage.

Norway shows us the way

Norway has a very progressive cinema industry of which restrictive access and policy are not enforced. As part of its unique approach, a research paper was created and published on 18th Jan, 2022. It is called "Digitizing Cinemas – Comprehensive Intended and Unintended Consequences for Diversity" and can be found here - https://www.tandfonline.com/doi/full/10.1080/10632921.2021.2018374

As part of its results, in the numbers given, we can see an example of how allowing cinemas to play content freely has significantly increased the viability of smaller cinemas, typically found in regional/rural areas.

Table 3. Repertoire in 2008, 2013, and 2017, and percentage change from 2008. (Taken directly from the report)

Small regional/rural cinema clearly flourished in this environment, growing significantly. On the other hand, the urban/metro locations were affected by the global trend brought on by fragmentation of entertainment choices (online gaming/streaming/internet) affecting cinema around the world, resulting in gradual decline in visits per year per person.

As the effects 45-day windows plus the 20 year trend in attendance per person per year slowly going down, for many small cinemas, without access to the advantages as demonstrated in Norway, the outlook and damage to cinema culture appears inevitable.

Why this will not happen

Unfortunately, unrestricted access to content and abandoning of policy for cinemas is unlikely to happen. In basic terms, if distributors allow a small cinema in a regional location to do this, they should also allow small cinemas in the metros to gain access to content under the same conditions.

If this occurred, a small cinema could pop up next to a multiplex in metro locations. Imagine a small cinema with 2-3 screens charging $10 per ticket (a common price in regional cinemas) popped up next door to a major chain with $22 tickets (a common price in metro cinemas) for exactly the same film and experience. That small cinema would be packed every day, eroding the BO gross return on the film for that multiplex and the distributor of the film.

Saving the regional small cinemas would come at a price to the distributors. A price I don't expect them to agree with.

What can be done

The outlook is not great but I feel a compromise can be achieved. Our industry has and is still going through a major change. I hope parties involved can come together and bring new rules to our industry to allow viable conditions for smaller cinemas. Otherwise, we are likely to see regional cinema greatly eroded and cinema as an entertainment activity evolve towards a less attended but more expensive activity. Think, going to a major music event. As a cinema person I would prefer to keep the culture of cinema a major part of our lifestyle. Like going out for a restaurant meal on a "regular basis" trying whatever food is on offer. The alternative is for cinema to become more like a specialised dining event at a high class restaurant occuring a few times per year at best. Think, everything is IMAX/PLF (Premium Large format).

If you are a small cinema owner, I recommend you share your experiences and the pressures you are under with distributors. Voice your concerns and that to keep viable we need flexibility and access to content as fresh as possible.

Good luck.

Regards,

James Gardiner

www.smallcinemaowners.com.au

Email: james.gardiner@smallcinemaowners.com.au