As small cinemas, picking the right films is of critical importance to making or losing money over a holiday period. Recently I turned to Google Trends to help select the films to play in my (3) small cinemas. Over Christmas I was please to see how Google Trends clearly did a great job at indicating Box Office winners and loser. Based on this I wrote an article for SCO members, of which has been picked up by a U.S. based cinema exhibition trade website “Celluloid Junkie”

I will quote the initial paragraph from the article below. Please do continue reading on Celluloid Junkie website from the link supplied below

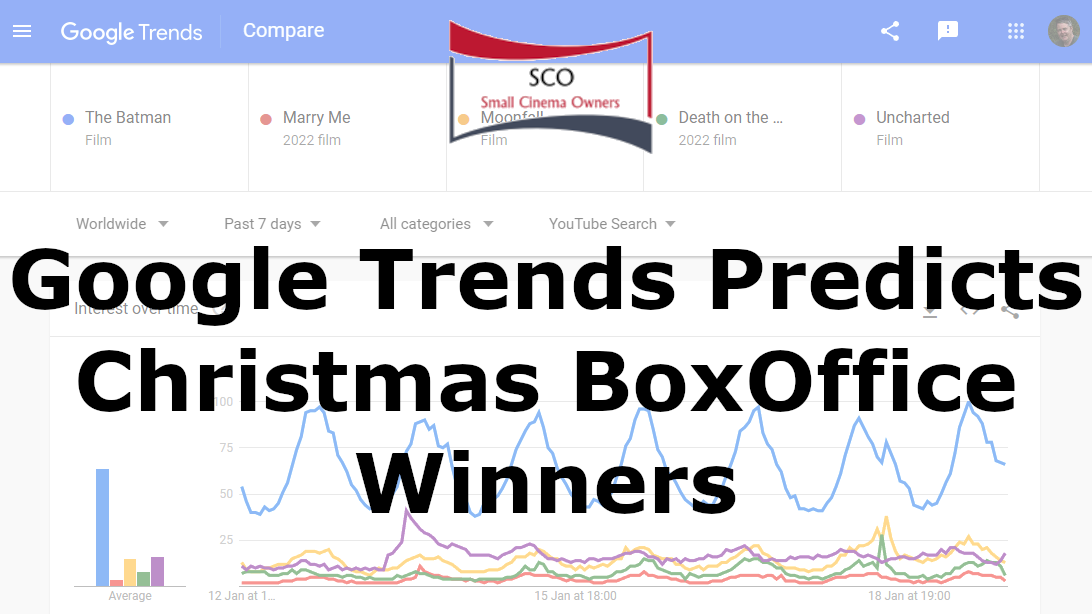

Google Trends predicts Christmas Box Office winners

Data has never been more important to cinema operators. Many large cinema chains trumpet how they are using analysis of data about their patrons to achieve better results. Smaller cinemas have been left behind as collecting and making sense of this data is expensive and nontrivial. Google Trends is a free data analysis service that cinemas can easily take advantage of. As small cinemas, we can only show a limited number of titles/films. Selecting the right films is of critical importance to achieve profitable results. Pre-Christmas 2021 I used Google Trends to select the titles to play. And the predicted result: 1 – “Spider-Man: No Way Home”, 2 – “Sing 2”, 3 – “Ghostbusters Afterlife”. And predicted Fails: “West Side Story” and “Matrix Resurrection”. I booked films based on these indications. A major win for my small cinemas.

Below I will walk readers through my approach and example of utilising Google Trends so any cinema owner can utilise these tools.

CONTINUE READING AT Celluloid Junkie (Note full article listed below for archival reasons.)

How does Google Trends Work

Google is an advertising company that uses data analysis to achieve better results for those who advertise with them. As part of this function, they track every search a user makes on “Google Search”, “YouTube” and many other affiliated platforms. With this data Google can then create comparisons in popularity for specific terms. This is the basis of how the tool works. But in a cinema owners case, we need to utilise it to better represent popularity in upcoming film releases.

YouTube is also a big part of Google. Over the COVID period, YouTube popularity has grown by leaps and bounds, making it a popular place for people to search for videos of topics they are interested in.

As a cinema we understand the importance of Trailers and how they can shape the demand of consumers. Conditions have changed, consumers now typically see a new movie trailer on YouTube before any other method. The use of Google Trends and the ability to examine the trends in what movie trailers people are searching for has becoming a extremely valuable insight.

How to use Google Trends

The Google Trends website is found HERE (https://trends.google.com) From the front page you can start entering a search term. After entering your first search term, you will be presented with the EXPLORE page, you can enter more search terms next to the “+ Compare” box at the top of the page. This is the very basic use of the tool. For a cinema owners a number of options are available to better represent the trends we are interested in.

- The Region: This will automatically select the region you are in. However, if the data is too thin and the result has to few data points, it is best to switch to “WorldWide”. The world wide trend typically holds to a similar result for tent-pole films with a world wide release.

- Time Frame: Typically your looking at films 30-60 days out, so getting the feel of the trends on a title only really requires a 7 day or 30 day sample up until the current date. I try to avoid a date range that exposes a trailer drop peak as it can distort the results. Remember, as time goes by the trend may change. Plus, if a major advertising push is occurring in your region, it may be a good idea to see if this is affecting the popularity of a film.

- Categories: Typically I leave this on “All Catagories” specifically when targeting YouTube searches. Otherwise the data set becomes to thin to make a judgement. Otherwise, if you are looking at a wide “Web Search” over a “YouTube” search, the use of the category “Arts & Entertainment” may surface some interesting insights.

- Search Type: The two important selections for a cinema owner are “Web Search” and “YouTube Search“. Typically I find searching “YouTube” for consumers looking for a specific trailer for a film is one of the best indicators of popularity.

Context is very important when using this tool. Unfortunately some films may have a very common name that could appear in other searches resulting in a contamination in the results. If this is the case, you must use your own evaluation of if the data represents the target film accurately. Typically if this happens, I recommend looking at trends on the term under different settings to identify if the term may be too generic and the trend level it achieves is contaminated by this characteristic. This would make it hard to estimate the popularity of that particular film.

When Google Trends displays popularity of a term or movie trailer name, it only shows a comparison between items based on a comparative basis with the top term achieving a score of up to 100 (Note: if a top score is 60, then this indicates the Term is at 60% of its peak historical score over an unknown historical range and was likely in the past, for example when a trailer dropped and caused the biggest spike in interest), and other terms then shown in relative comparison to the most popular item. For example. The most popular term may be Term A at 60 and the second most popular term, Term B at 30. From the data we cannot really conclude how popular a search for a trailer title is, but we can perceive how popular one film is compared to another. Typically I would search for 5 different film names at the same time, making sure I have the likely most popular films also listed. This acts as a reference point. As a cinema owner, we have an idea of the popularity of the films, its understanding which films are going to be more popular than others that the Google Trend tools expose.

IMPORTANT NOTE: When typing in a Title, a dropdown of suggested titles to search for will be listed. Typically it may say “Title” and under that “Film” if this occurs make sure you select this subcategory.

Learn by example

At this stage I think it best to go through an example of the current trends of films I am considering for my locations at the time of writing this.

Firstly, let’s get a visualisation of the release slate in my region. Following is a screen grab of a free to use slate timeline visualisation tool.

This tool is a free tool exhibitors can use in Australia. Get on to me if you are from a Cinema Association in a different region that may want to also offer this tool to your part of the world. Happy to help.

In this tool we can see a number of films coming out in coming weeks. Lets focus on.

- Moonfall

- Jackass Forever

- Belfast

- Marry Me

- Death on the Nile

- Uncharted

- Dog

- Cyrano

- The Batman (The reference file expected to be most popular)

- Downton Abbey 2 (Note, this film has since been pushed down/later in the slate.)

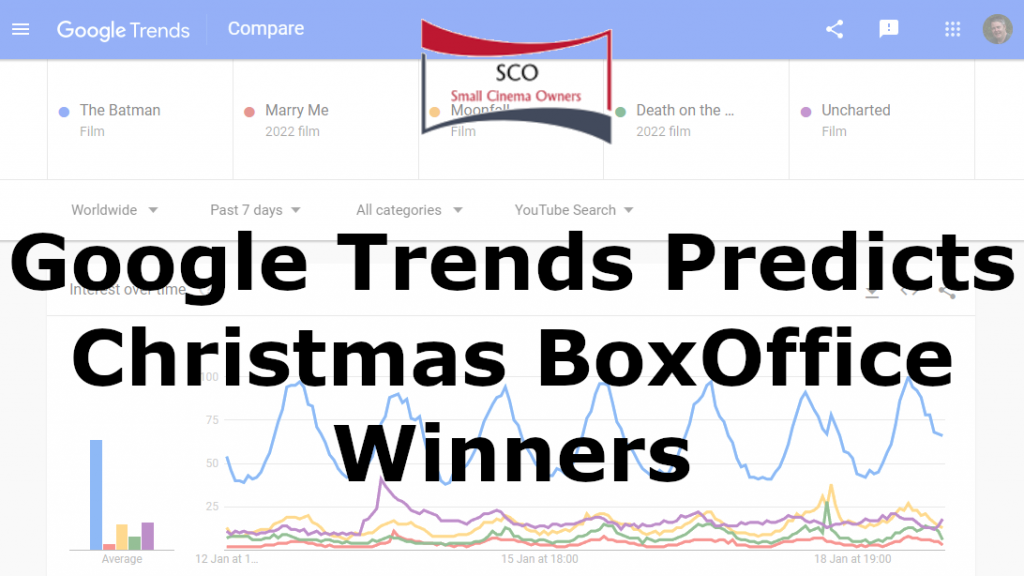

If we then use the Google Trends tool, comparing 5 Items at a time, with one of the Items always being “The Batman” as a reference point.. In this case we are doing “WorldWide” comparisons. A more local comparison would also be encouraged. In the example below I do both, World Wide and Australia.

NOTE: the “Dog” movie, the search term was changed from just “Dog” to “Dog Movie” as Dog is to generic and a good example of how the name of a film, if to generic, becomes very hard to judge as a general trend or a consumer looking for a trailer for the film. You can see this in the example below.

Example (Based on 19th Jan 2022)

Based on this we come up with the following popularity numbers for each title..

| Movie Title | WorldWide | Australia |

|---|---|---|

| Moonfall | 15 | 6 |

| Jackass Forever | 28 | 25 |

| Belfast | 2 | 2 |

| Marry Me | 4 | 1 |

| Death on the Nile | 8 | 2 |

| Uncharted | 16 | 9 |

| Dog (Movie, no film sub category available) | 33 | 11 |

| Cyrano | 1 | 2 |

| The Batman (Reference) | 64 | 33 |

| Downton Abbey 2 | 0 | 0 |

The analysis was performed on the 19th of Jan 2022, note results will change over time.

Based on these numbers I would make the following determinations when targeting my 3 regional cinemas. As these locations are 1 screen, 1 screen, 2 screens locations, this is how these results look from my perspective. Please apply them to your location based on demographic strength and screen numbers:

- The Batman has a lot of interest and is a must Play (Obviously) if you can handle the Policy and commitment requirements. Being a 3 hours long film, I have no choice but to wait until 3rd week for 1 screen locations. It’s physically impossible to do the minimum commitment.

- Moonfall has decent traction and is worth a run.

- Jackass Forever is surprisingly strong, however it’s target demographic are likely very active on YouTube. If you are strong in the target demographic it looks promising. (However, it’s not a strong demographic for my locations so I will pass on 2 of three sites)

- Belfast, weak, likely pass but will wait until first weekend traction. If older demographic show interest then go 3rd week out of policy.

- Marry Me, weaker than expected. Consider Pass unless you have nothing else much to show. However its a good feel comedy, of which I would like to push due to COVID bringing the public down.

- Death on the Nile, reasonable, however weaker in Australia than expected. On the fence but leaning towards.

- Uncharted, not surprising as “Tom Holland” is coming straight off Spider-man. A must have.

- Dog, as this film’s name is so generic, the results cannot be trusted. However, I feel it has decent traction and is suited to the mood of the public. On the wall, but leaning towards showing.

- Cyrano, extremely weak and as other musical genre films have done poorly, pass, consider for later run for older demographic based on week 1 weekend gross.

- Downton Abbey 2 is surprisingly weak, however it is still a long way out from release. I would re-examine this closer to release and after the studios have done some marketing. (Update, since writing, this film has moved down the slate. Likely as the distributor is acknowledging the lack of traction and poor environment would make this a prudent decision)

Armed with this insight, you are now in a much better position to book films that are more likely to be successful over the coming weeks.

In the coming weeks I will review these results and see how accurate they prove to be (or not).

Wishing you all the best with your cinema.

James Gardiner

Founder, Small Cinema Owners Association

james.gardiner@smallcinemaowners.com.au

mob: 0412997011