Wow, it’s been 3 months since the last newsletter, and gee, a lot has happened in the exhibition space. In this newsletter, I wanted to focus on Premium Large Format (PLF). Where all the fuss about it comes from and specifically what it means for smaller independents.

Alongside PLF, a number of other critical issues have surfaced—ones that speak directly to the long-term viability of our industry. So let’s explore them together in this SCO newsletter.

As in most of my newsletters, we will look at the cinema industry score card. Considering the difficult times the whole of Australia is in economically, and the effects of the topics covered, having a grounded position is the best way to approach these topics.

The Cinema Industry Score Card

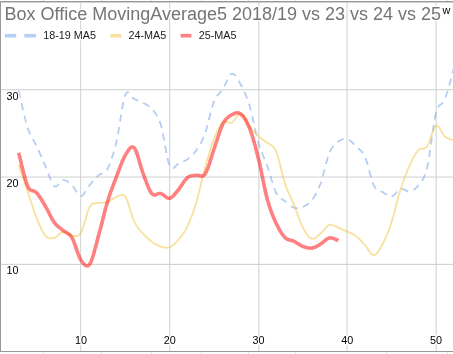

We started 2025 with optimism. The slate looked stronger than the previous year, and many hoped for a meaningful recovery. Unfortunately, reality has tracked almost exactly as my earlier analysis predicted. Here is the graph:

The second quarter outperformed expectations, but subsequent films have been weak, despite higher hopes. Yes, we are currently 3.5% ahead of 2024 on a year-to-date basis. But that falls well short of the 10–15% lift many expected. And importantly, the troughs are just as deep as last year—a clear sign that consumer behaviour has not shifted. The gains are simply the product of stronger titles rather than a fundamental recovery.

The truth is sobering: this may be the new normal. We should expect fluctuations, but around today’s levels. My current projection is a year finishing roughly +3.5% as currently tracking with a ±2% by year’s end compared to 2024. A welcome improvement, but far below what many locations need.

Despite this, the industry deserves credit for holding onto as many screens as it has. Yet, contraction seems inevitable as supply and demand rebalance.

🎧 Recommended listen: Box Office Pro’s podcast “The Year of Underperforming Films – Summer Recap & September Preview.”

Economic Backdrop

The outlook is shaped as much by economics as by slates. Australia is in the grip of a rental and mortgage crisis, a cost-of-living crisis, and we’ve just had an “Economic Reform Roundtable” that delivered no meaningful solutions. Interest rates are edging down, but only because monetary conditions remain tight and disposable incomes are shrinking.

And yet, compared to other sectors, cinema has shown remarkable resilience. Consider this: one-third of live venues have closed since the pandemic, while most cinemas have survived.

Still, many independents are only keeping the lights on by cutting costs, delaying upgrades, and working harder than ever. This is a “run faster than the bear” race: survival often comes at the expense of those who stumble.

Historical Parallels – A Warning from the Past

If you remember the 1960s through the 1980s, you’ll recall the dark days of clearances and exclusivity. Cinemas were granted geographic exclusives—sometimes the only print for an entire city or suburb. Many independents outside the majors simply couldn’t access films when they mattered. By the mid-1990s, after widespread closures, the ACCC stepped in. The result was the Film Exhibition and Distribution Code of Conduct (1999), designed to give independents fairer access and arbitration rights.

Today, with independents again on the ropes, we cannot allow history to repeat itself.

K-Pop in the coal mine

On August 23, Netflix’s sensation “K-Pop Demon Hunters Sing-Along” was released exclusively to a major exhibitor in Australia. While Netflix hides box office numbers, in the U.S. the film topped the charts, and it likely ranked first or second here.

Exclusivity gave that chain a decisive competitive advantage—and left independents locked out. If such practices spread, contraction will disproportionately target independents.

This was nothing less than a direct attack on smaller cinemas. We should be at DEFCON 1: the future of independent exhibition is under real threat.

[Newsletter EDIT, for members only content not included]

Integrators and vendors close ranks in a tight market

The Rise of Exclusive Support Agreements

Another major shift in the industry is the tightening of support agreements between vendors and integrators. On one hand, it’s understandable—equipment sales and servicing revenue have dropped, and vendors are under pressure to protect the integrators they rely on. But the result is troubling: exclusive support agreements are becoming the norm.

Take projectors, for example. If you want to purchase a particular brand in Australia, you may now be locked into using a single designated integrator. That integrator, in turn, only sells certain brands of servers, processors, amps, or TMS software. Once you’ve committed, your ability to mix and match products—or to seek better prices and conditions from alternative integrators—vanishes. In Australia today, choice is no longer on the table.

Advice for Cinemas

Given this environment, my strongest advice is this:

- Bring in trusted, knowledgeable experts—people who understand the technology and the business landscape—to represent you.

- Scrutinise vendor proposals carefully before signing commitments.

- Apply collective pressure where possible. A lone independent has little leverage, but informed scrutiny can at least keep suppliers honest.

We may no longer have the independent integrator we were promised, but we are not powerless. Our strength lies in expertise, transparency, and solidarity.

Premium Large Format (PLF) and how it fits in with smaller independents.

The exhibition industry worldwide is under pressure. In recent years, the dominant conversation has been: how do we bring audiences back to pre-pandemic levels? The loudest answer has been PLF—Premium Large Format—or more broadly, premium experiences.

Premium formats have been indexing higher than standard auditoriums in the current market. In other words, they’re outperforming traditional screens. To understand what that means for smaller independents, let’s break the topic into parts—because each element carries different weight depending on your market, competition, and capital constraints.

“PLF” has drifted from its original meaning

Historically, PLF meant just that: large screens (20m+), big sound—an IMAX-like experience without the licensing. Today, “premium” covers a much wider range: recliners, HDR projection, motion seating, ScreenX, architecturally distinct rooms, and more. These don’t always align with large auditoriums, which is why the term PLF can confuse. In practice, Premium Format is the more accurate umbrella, with PLF now just one subset of “premium.”

Australia’s unique baseline

Unlike many markets, Australia has long had a surplus of PLF-style screens in the traditional sense. They may not be tagged as PLF in Comscore/Numero (e.g., like IMAX), but the big chains have long offered IMAX-adjacent experiences—Vmax, Titan Luxe, etc. That makes it harder to isolate PLF’s incremental impact here versus markets where PLF is scarcer.

The IMAX effect

Using F1: The Movie as a case study with Comscore data: roughly 1.3% of locations (the IMAX sites) delivered about 6% of national box office—a strong index. We don’t have visibility into whether Vmax or Titan Luxe similarly over-indexed (only the majors see that data), but the behaviour of the majors speaks volumes: Village, EVT and Hoyts all announced IMAX agreements this year.

This raises a critical question for independents: are customers choosing objectively better images/sound, or the perception of a better-branded experience? In a margin-tight market, that distinction matters. The majors’ current push looks less like growing the total pie, and more like fighting for share of a flat pie—trying not to be the one “eaten by the bear.”

A quick tour of other premium options

- Recliners. Formerly premium; now an expectation in metro markets. Regionals can still treat them as an upgrade, but commercial urgency varies with local competition.

- Motion seating. Strong in parts of Asia; niche in Australia. Works with specific titles, but risks oversupply and under-utilisation—typically not a fit for smaller catchments.

- HDR projection. The most compelling blue-sky premium right now. IMAX is the convenient path today, but newer HDR systems are emerging with superior technical ceilings. Expect an HDR “arms race” because it’s where formats can claim a clear advantage.

- Environmental/architectural experiences. Unique rooms, beanbags/“soft seats,” themed spaces. Can be memorable, but often fad-sensitive (i.e. Planet Hollywood) without sustained programming and brand support.

IMAX vs other image/sound leaders

IMAX is the brand leader in premium awareness. Dolby Cinema is also expanding (from a smaller base, and not present in Australia), and HDR by Barco is the newest high-ceiling entrant. For Australian incumbents, IMAX has the marketing momentum and a relatively fast retrofit path. Often re-badging in-house-PLF rooms and installing IMAX projection, typically resulting in a smaller image due to ratio and peak luminance limitations. That speed matters to public companies under pressure.

The trade-off: IMAX isn’t the most capable HDR implementation technically. Newer systems push higher brightness and lower blacks, which materially improves perceived contrast and “pop.”

Brightness & black-level comparison (2D)

| System | Peak Luminance (fl / nits) | Minimum Black Level (fl / nits) |

| IMAX with Laser | ~22 fl / ~75 nits | ~0.002 fl / ~0.007 nits |

| Dolby Cinema | ~31 fl / ~106 nits | ~0.0, due to unique light mitigation technology |

| HDR by Barco | ~110 fl / ~375 nits | ~0.0005 fl / ~0.0017 nits |

Notes: Domestic “Dolby Cinema-grade” projectors aren’t yet generally available; future mass-market units will likely sit ~106 nits or under on smaller screen sizes. Christie’s forthcoming HDR approach is unreleased; capabilities TBD, but unlikely to be over ~106nits

The direction of travel is clear: higher peaks + deeper blacks win, particularly in real-world auditoriums with some ambient light. That’s why Vue launched its own EPIC by Vue—pairing HDR by Barco with Dolby Atmos—choosing a technically superior long-term path over near-term IMAX brand equity. The Vue CEO explains HERE why they chose to go with their own brand.

The coming saturation problem

Here’s the catch: while premium formats are currently indexing higher, this uplift is fragile. It doesn’t take much expansion before the segment saturates—too many premium seats chasing too few premium-paying customers. When that happens, price compression sets in. Margins thin, returns on capex fall, and the “premium” uplift starts to look ordinary.

That’s why the majors’ investment push is best understood not as growth strategy, but as defensive strategy. In a shrinking market, nobody wants to be the chain that failed to upgrade, lost share to a better-branded competitor, and stumbled into the jaws of the bear. Premium formats are less about expanding the pie, and more about making sure you’re not the slice that gets eaten.

What this means for smaller cinemas

For most small independents, the headline is blunt: you’re unlikely to install these “big toys” in the next cycle. Many of us are fighting to sustain a solid, clean, welcoming baseline experience. In isolated markets, the ROI on premium add-ons is questionable.

- Mini-majors/metro players: Yes—premium should be on the table now, but with clear eyes about title volatility. Experiential titles are less frequent; troughs are deeper, which increases risk on larger capex.

- Regionals/single-sites: Focus on reliable core quality and selective, customer-visible upgrades that fit your competition set (e.g., targeted recliner rows, sound upgrades, showmanship). Premium can shift share in competitive markets, but it’s not a panacea.

As a long-time CineTechGeek and exhibitor, I’ll add this: home image quality has leapfrogged expectations, while cinema has largely stood still since the digital transition. The premium race is pushing the next standard (true HDR, light steering, better blacks) into the high end first. Even if you can’t buy it today, that tech will trickle down. The projectors you replace in ~10 years will likely include HDR-class capabilities as standard.

In the meantime, keep investing where it counts for your audience: reliable presentation, honest brightness/contrast, crisp audio, comfort, cleanliness, and hospitality. That’s the independent advantage—done consistently, it’s still the best retention tool we have.

As always, feel free to email me with any questions you may have.

Principle, Small Cinema Owners (SCO)

James Gardiner

james.gardiner@smallcinemaowners.com.au